Retirement Download

Strategies for a successful retirement

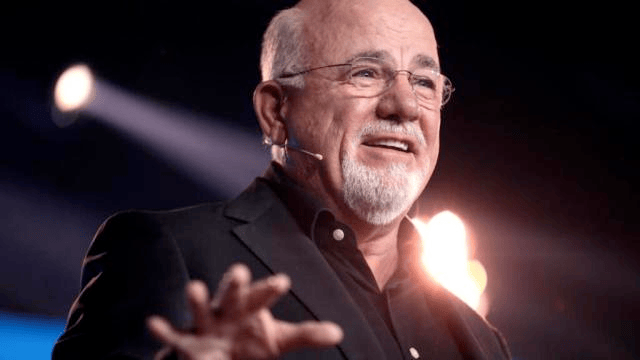

Don’t listen to Dave Ramsey, say analysts

Dave Ramsey, known for his YouTube videos and financial tips, often ends up in hot water due to his controversial remarks. Not all of his opinions are met with acclaim, including one he gave on-air about the popular 4% rule for retirement withdrawals.

The incident happened a while ago but it’s still being discussed since so many people follow the 4% rule.

What is it about? It all started on ‘The Ramsey Show’ when a 30-year-old man with $120,000 already saved for retirement called to discuss retirement. Not sure of his financial situation, he asked what percentage of his assets he should plan to withdraw in retirement over a 30-year time period.

The conversation revolved around a YouTube video published by The Ramsey Show” co-host George Kamel, in which he told viewers to follow a 3% withdrawal rate if they want their nest egg to survive over 30 years or longer.

Ramsey doesn’t agree: Ramsey called this advice “ridiculous” said he’d be “perfectly comfortable” withdrawing 8% per year, assuming you can earn a 12% annual return from “good mutual funds” — in line with the S&P 500, which has earned an average annual return of 11.8% since 1926 — and you set aside 4% for annual inflation.

The world has a problem: This advice did not go well with other financial advisors who are calling it “scary,” and “incredibly dangerous.”

What’s wrong with it?

The 4% rule is the go to option for most retirees, Ramsey’s 8% suggestion is double the amount. He justified it with this statement:

“It’s too low! It's not realistic. You do not need to live on 4% of your money for your nest egg to survive.”

“Where the flip is the other 8% going?” said Ramsey. “Well, 4% of it went to inflation [and] the other 4% is just sitting there, so you’re growing your investments instead of living off of them. I'm not destroying the nest egg, I’m not even touching [it]. I’m growing the nest egg by leaving 4% in there and taking 8% off of a 12% growth rate,” he added.

His suggestion doesn’t. work because it rests on assumptions. You can never be sure how much you will make because returns aren’t guaranteed. Plus, his suggestion “doesn’t account for investment volatility.”

What do others say?

Dave McKnight, author of “The Power of Zero” took aim at Ramsey in a Youtube video where he said the radio host was “living in a fantasy world where he thinks these kinds of stratospheric distribution rates are sustainable in retirement.”

Fellow personal finance author, Rob Berger, made a similar point on his Youtube channel: “Dave is fundamentally wrong. Without equivocation, he is wrong. An 8% withdrawal rate would be incredibly dangerous.”

Berger called out the over-simplicity of Ramsey’s argument: “I will certainly agree with Dave that 12 - 4 = 8, but that’s about where our agreement ends.”

He used Portfolio Visualizer to show the CAGR for U.S. stocks was actually 10.25% from 1972-2023, thus proving Ramsey wrong.

Caleb Hammer, a personal finance personality who focuses on helping people out of debt, described the advice as “scary” and highlighted that only 32.5% of people would still have money in their nest egg after 30 years of retirement.

How much to withdraw?

There is no straight answer to this question. The 4% rule works for some people but it might not always be the best option. We think you can do better by finding your personalized spending rate.

Here’s a chart that could be of help:

A good rule of thumb is to take no more than 5% of your household savings in the first year of retirement

You can then adjust this figure based on a range of factors, such as your retirement timeline and how confident you want to be that your withdrawals are sustainable.

Reminder: The longer your retirement, the lower your withdrawal rate should be, to make your money last.

Also, the higher the probability of the retirement savings being sustainable, the lower the recommended withdrawal amount. So, it is safe to say that you can withdraw more than 4% but that depends on how much money you have, what age you are retiring at, and what sources of income you have after retirement.

Check this video for more tips:

Sponsored by Masterworks

Here’s what you can do when your bank starts apologizing

You may have gotten a ‘sorry’ email from your bank, saying that if you had a 5% APY cash account, that privilege is being snatched away. And with interest rates set to keep sinking… where to pivot? But now, for a slice of their portfolio, Masterworks’ art investing platform is offering shares to 66,000+ investors, with each of their 23 sales individually returning a profit to said investors. With 3 illustrative sales, Masterworks investors have realized net annualized returns of +17.6%, +17.8%, and +21.5%!

Past performance not indicative of future returns. Investing Involves Risk. See Important Disclosures at masterworks.com/cd.

Resources

How was today's newsletter?

👩🏽⚖️ Legal Stuff

Nothing in this newsletter is financial advice. Always do your own research and think for yourself.